Considering the size of the textile and fashion industry—a roughly $2 trillion market annually—as well as its environmental impact—roughly 8% of global greenhouse gas emissions—it is surprising that investors are still reluctant to invest in clean fashion manufacturing. While some might think of “fashion” as a risky venture (prone to passing trends and transient brands), the apparel supply chain is a proven, reliable source of returns and, as importantly, full of opportunity for systemic change that will yield even higher returns for investors.

I believe that the heart of apparel is in manufacturing, not in retail. It is the manufacturing infrastructure that steadily creates clothing year in and out, and it is the apparel supply chain that produces, processes, dyes, and finishes raw materials into garments. This also means that CO2 emissions, chemical pollution, and the vast waste of water resources are all concentrated in this end of the industry. Hence, from an environmental and social point of view, the manufacturing sector needs innovative, upgraded, and retrofitted technologies that decrease carbon, water, and chemical pollution. But investors seem to overlook the financial appeal of such necessary, systemic change in the industry: these technologies will also increase the efficiency, quality, and cost structure of apparel manufacturing.

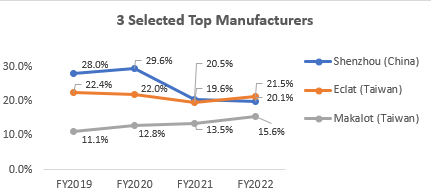

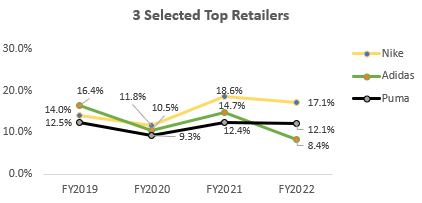

While investors have been slow to realize the potential in apparel manufacturing, financial markets have already proven the industry’s value. As illustrative examples, take large fashion industry manufacturers such as Shenzhou International (China), Eclat (Taiwan), and Makalot (Taiwan). These manufacturers have embraced investments in innovation and sustainable manufacturing for many years; as a result, they have been steadily and consistently rewarded with company valuations based on earnings multiples higher than their peers and the top fashion brands they serve. Their investments in responsible technologies and practices have led to higher efficiency and better quality, resulting in higher margins, all while distinguishing their brands as leaders in sustainability. In the following graphs, we show how these manufacturing companies outperform top fashion retailers in earnings, and ultimately maintain higher average valuation multiples.

EBITDA Margin Comparison: Top Manufacturers versus Top Retailers

Valuation Multiples: Top Manufacturers versus Top Retailers

* “Best-in-Class Manufacturer Average” calculated after considering 8 renown manufacturers across China,

India and Southeast Asia.

# “Best-in-Class Retailer Average” calculated after considering 7 world-class retailers

This industry leadership is not the prerogative of large companies alone: smaller companies dedicated to responsible manufacturing also see above-market financial returns. To mention a few industry standouts: Jeanologia (Spain), with Carylyle as a minority shareholder since 2019, has led responsible denim manufacturing (see the Jeanologia 2020 environmental report), offers revenue growth opportunities for customers by collaborating with brands and likeminded industry operators such as Archroma (a company that produces sustainable dyes). Saitex (Vietnam), often labelled the most sustainable denim manufacturer in the world, has for over a decade made responsible manufacturing its core selling point and gained the trust of many fashion brands. Finally, companies innovating the dyeing and finishing process stand to deliver the most significant environmental returns: CleanDye and NTX Cooltrans can deliver substantial reductions in CO2 emissions and water consumption—proven with certified lifecycle assessments—while building resilient, successful businesses.

Ultimately, the convergence between positive environmental impact and significant financial returns is fundamental and even intuitive. Investment into the development and implementation of technologies such as waterless dyeing, precision cutting, chemical free washing, zero discharge processes and supply chain digitization drives efficiency and resource conservation, which translates into higher profitability. Investment in workforce welfare drives less absenteeism, less employee turnover and a more highly motivated workforce, which translates into continuous improvement and higher productivity. Companies who understand these dynamics have a natural commercial strategy that differentiates them as responsible suppliers, which global brands need to meet their sustainability agenda.

So why is capital not flowing at a higher pace into this supply chain?

Investing in manufacturing is often capital intensive and requires more time to produce an attractive return on investment compared to other “fashionable” investments in the financial community, such as software and technology. But manufacturing investment can also be a less risky return: an increasing global population will need increasing quantity of clothing, and without an obvious substitute, these clothes need to be manufactured somewhere. And at times like the present, when software companies are shrinking, it would serve us well to reflect on the value of longer-term investments in hardware, infrastructure, and resilient industries like apparel. Alongside calls for climate action and worker welfare, we should also call for capital to drive this change.